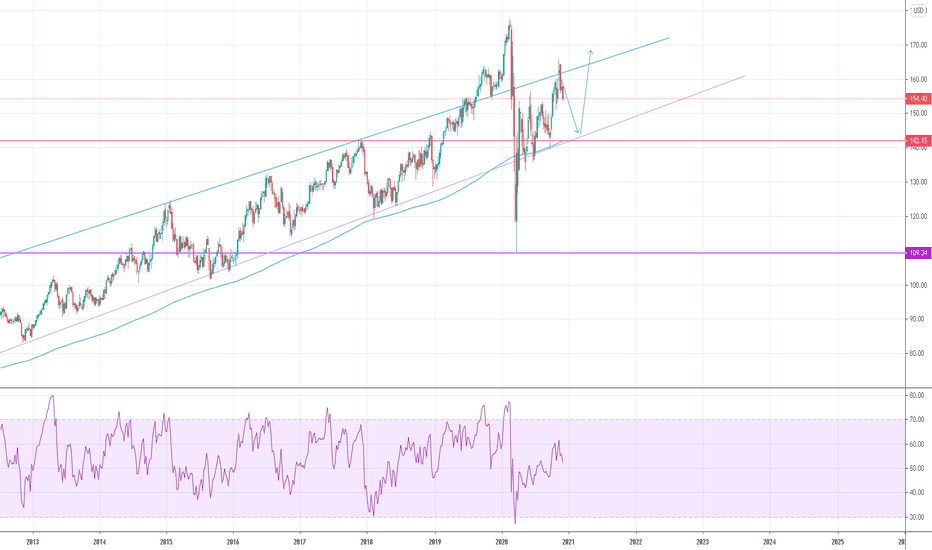

Dow Utilities and what they are indicating for the markets

Dow Jones Today: The Dow Utilities via (IDU) surged to new highs In Sept and per the Tactical Investor Dow theory, the Dow should follow in its footsteps and it did so. The Dow set new highs both in Nov and December. The laggard so far is the Dow transports and in due course it to follow the same path.

Both Dow transports, and Dow industrials are trading in the extremely oversold ranges, so technically they have plenty of upside potential. On the other hand, the Dow Utilities are now trading in the extremely overbought ranges, and the next bearish MACD crossover is likely to lead IDU(a proxy for the Dow utilities) to pull back to the 133-139 ranges, which would translate to a move to the 9300-9600 ranges for the Dow Utilities. If it comes to pass, the pullback should be treated as an opportunity.

If the Dow utilities pull back, then the Dow will follow in its footsteps too; therefore, the intensity of the next pullback will determine if the pullback the Dow experiences will range from mild to wild. The trend is still positive, so we will only be looking at the pullback from an opportunistic perspective; in other words the stronger the deviation from the norm the better the opportunity.

Overall we expect the transportation and several stocks in the Dow industrials to outperform the markets. When a sector is hated, and the trend is up, it’s probably the perfect time to establish long positions in that sector.

If the utilities close below the 801 to 804 ranges or IDU closes below 141 on a monthly basis, then the first breakout attempt by the Dow transports is likely to fail. This will convince everyone that the transportation sector is going to breakdown, but precisely the opposite will transpire. If the Dow transports trade below 10500 for three days in a row, the odds of a move to the 9300 to 9600 will spike significantly. Again any pullback should be viewed through a bullish lens. Overall we are also expecting the transportation sector to outperform the market over the next 9-12 months.

It is quite astonishing to see bullish readings continue to decline while the market is trading close it’s all-time highs. The anxiety gauge has pulled back and is now trading very close to the Panic zone. Market Update Nov 30, 2019

The Dow is trading close to 28K again and if one looks at the sentiment, one would be inclined to think that it was trading closer to the 26.5k ranges. Neutral sentiment has inched up another two points and its almost at a 3 month high. Bullish readings are well below their historical average of 39. Overall market sentiment is indicating that a strong pull back if it comes to pass, has to be viewed as an opportunity.

In short, we can conclude that next year’s market action will catch 90% of experts with their pants down. All the experts, even those who got the first part of this bull market right, are wearing their emotions on their sleeves. How do we know? All one has to do is pay attention to their political bias? If you have a bias (be it politics or finance), your vision is clouded and hence your analysis.

Courtesy of Tactical Investor

Dow Jones Today, Stocks Rise As Record Jobless Claims Boost Stimulus Pressure

Stocks jumped at the starting bell Thursday, after a record spike in weekly unemployment claims turned up the heat on Congress to push through a $2.2 trillion coronavirus stimulus package. Meanwhile, Boeing (BA) and Intel (INTC) led the few early advancers on the Dow Jones today.

Coronavirus stocks Co-Diagnostics (CODX) and BioNTech (BNTX) spiked in early trade. CNA Financial (CNA) soared 37%. Signet Jewelers (SIG), Viomi Technologies (VIOT) and Canadian Solar (CSIQ) all scored double-digit gains on earnings news.

The Nasdaq jumped 2%. The S&P 500 advanced 2.1%, and the Dow Jones Indutrials grabbed a 1.9% gain. The Dow and the S&P 500 are each looking to chalk up their third straight advance.

Markets across Asia lost ground overnight, particularly in Japan. Europe’s markets traded sharply lower near mid-session, despite the European Central Bank eliminating its ceiling on its bond purchases to fight the economic impact of the coronavirus emergency.

U.S. bonds continued higher, sending the 10-year yield down 8 basis points to 0.79%. Oil prices struggled to turn a five-week nose dive, with West Texas Intermediate up more than 6% for the week, but trading down 3.5% early Thursday to below $24 a barrel.

Gear up for Thursday’s market action by reading IBD’s Investing Action Plan.

Micron Leads Nasdaq; Boeing Tops Dow Jones Today

Broadcom (AVGO) and American Airlines Group (AAL) topped the Nasdaq 100, up 6% each.

Boeing led the S&P 500 and the Dow Jones today. Full Story

This Is Why the Dow Jones Just Crashed 3,000 Points

Despite a bout of aggressive dip-buying, the stock market sold-off again, leaving Dow bulls with another grisly 2,500 point drop. | Source: AP Photo / Richard Drew

Another day, another circuit breaker for the Dow Jones, as the stock market hit limit down almost immediately.

Despite a brief bounce, the coronavirus battle looks increasingly like a marathon and not a sprint.

Dow bulls saw their positions smashed as big banks halted buybacks, oil companies faced credit downgrades, and Boeing collapsed 23%.

The Dow Jones plunged nearly 13% on Monday, triggering circuit breakers and erasing most of last Friday’s impressive gains.

Despite a bout of aggressive dip-buying, the stock market sold-off again, leaving Dow bulls with a grisly 3,000 point drop.The Dow Jones crashed just under 3,000 points on Monday. | Source: Yahoo Finance

All three of the major U.S. stock market indices were hammered when the opening bell rang. The Dow Jones, S&P 500 and Nasdaq all accelerated their losses late in the afternoon.

The Dow crashed 2,998.9 points or 12.93% to 20,186.72.

The S&P 500 dropped 11.98% to 2,386.19.

The Nasdaq fell 12.32% to 6,904.59.

It was a rout in the commodity sector. Crude oil lost 9.6% and Brent 12%. Both benchmarks slid below $30 per barrel, and markets likely haven’t yet quantified the astonishing build-up of inventory as both Saudi Arabia and Russia turn on the taps. Full Story